Quick Commerce – Myopic view powered by business fundamentals, or a long-term view built on customer habits?

Article written in May 2024 (Image source: Primac Pecan)

Why are we talking about Quick Commerce?

The evolution of E-commerce in India has been a fascinating story with changing dynamics around Quick commerce. The story of 10 min vs 20 min vs 2-hour vs 1+ day delivery has challenged business fundamentals for sure, with business leaders taking sides. Close to 2 decades back, Amazon came out with 2-day shipping, which at the time seemed unprofitable and grabbed headlines as well. Well today, a 2-day delivery feels obsolete.

Let’s look at this from few angles –

- Gross merchandise value (GMV): The GMV value in USD in 2021 stood at $04 Bn and as of 2023, hit a GMV of $2.8 Bn. The projected value of GMV in 2030 is $9.9 Bn, with a CAGR of 22%. Although Quick commerce as a % of E-commerce’s is still projected to be <10%, the customer touchpoints and the wave of growth cannot be ignored

- SKUs comparison – Quick commerce operates through small dark stores set up efficiently to deliver goods. A dark store has ~6000 SKU’s compared to a Kirana store with 1000-1500 SKU’s. The only comparison for a dark store would be Modern retail which has 15,000+ SKU’s. A dark store has wider variety of goods and often have fresh food, poultry as well, giving consumers a wide array of choices

- Current presence of Quick com firms, targeted to <30 cities– The players in the market are only present in <30 cities and the GMV figures represent only a fair chunk of Indian population. A solution for Tier 2,3 is yet to be considered and by then, the GMV figures would have a >50% CAGR.

Market dynamics and deep-dives

- Number of players – There are 4 players operating in <20 minutes segment with >95% of market share (GMV) held by Blinkit, Swiggy Instamart & Zepto followed by Tata backed Big basket (BBnow service). Blinkit is the market leader with 40% share, followed by Swiggy Instamart with 32%, Zepto is the 3rd player with 32% and rest is Bigbasket.

- Market defining KPI’s are led by Blinkit in all aspects –

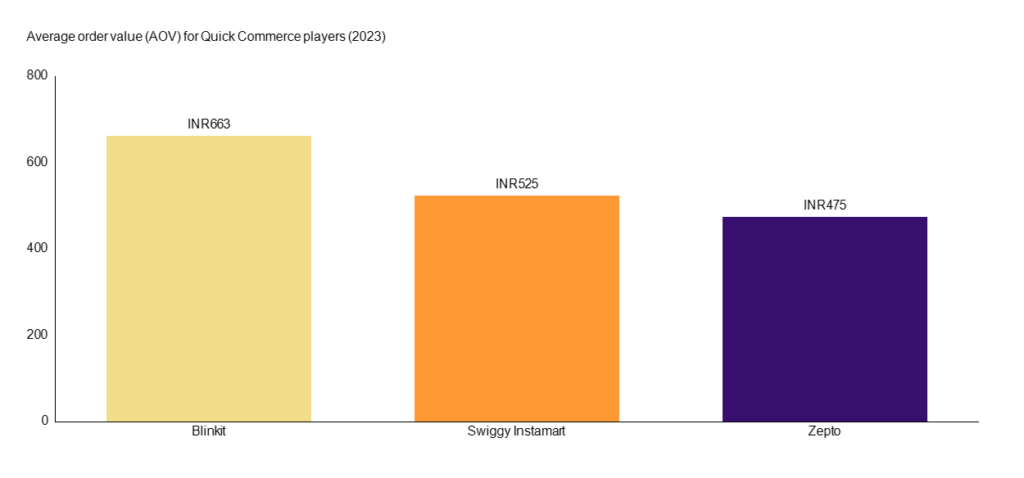

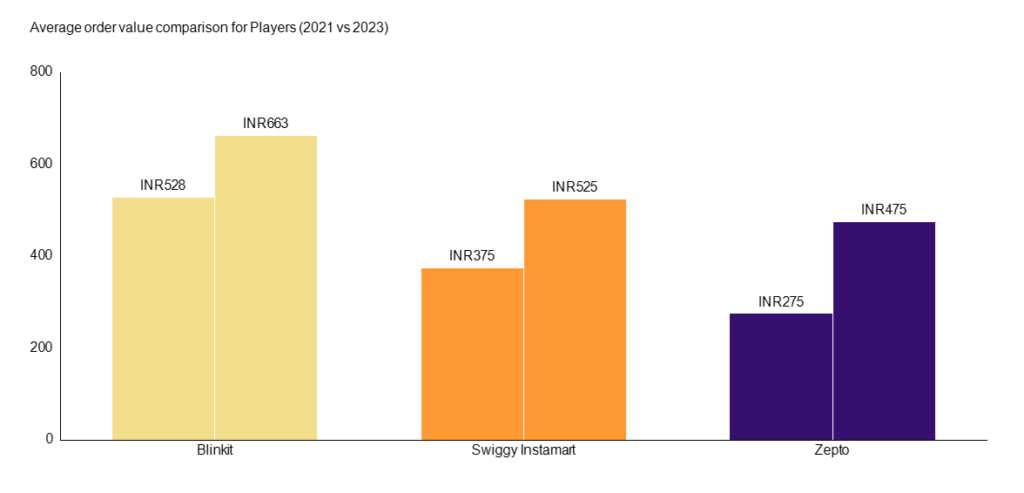

- Average order value (AOV) – Blinkit has a higher AOV with ~663 by a 25% margin and the change has been seen in the last year. A higher AOV is a lever to reach to profitability earlier (will be covered in coming sections)

- Cities presence – Zepto has the lowest presence in terms of cities covered with only 10 under their umbrella. Other two players have roughly the same presence with 25 cities coverage

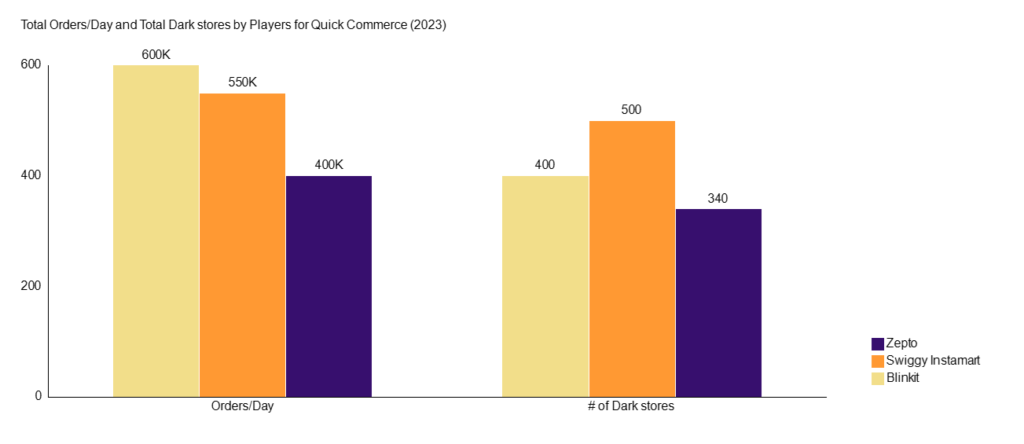

- # of dark stores – One KPI where Swiggy has a higher dark store presence compared to Blinkit, but the AOV and GMV figures point to a better utilization of orders served for Blinkit

- # of orders/day – Blinkit serves 6Lakh orders/day with Swiggy ~5.5Lakhs and Zepto ~4Lakh.

3. Comments on Profitability – The firms are currently burning cash with net profit margins for Blinkit (-119%), Swiggy instamart (~-50%) & Zepto (-63%) respectively. However, the founder of Zepto believes the firm will be able to reach profitability (EBITDA level). 2-3 years into this evolution, there would come a point wherein business fundamentals will be tested. With the major players vying to be part of the public markets, the ability to churn out profit margins in the range of 0-10% will be the differentiator going forward

Deep dive into Unit economics of Quick commerce (Dark store perspective)

Alright, let’s get into some number crunching to see financials from the lens of a Dark store for the top 3 providers. We will be breaking down operating margin and Net profit margin – Please find the link to access the drive link for the model – Sheet link

Insights –

- Operationally, the dark stores are maintaining a positive margin positive in a range of 5%-30%. Fixed costs make up only ~25% of the GMV margins with delivery costs making up ~55% of the GMV Margins

- Net Profit margin for a dark store is negative in the range of -50% to -115% due to higher cost of acquisition and discounts. Discounts make up ~18% and acquisition costs equaling the GMV margin %

Elephant in the room – Road to profitability?

Broadly – there exists 5 levers to pull for the quick commerce companies and these would be the major driving forces for a path to profitability.

- Lever 1: Ad revenue

- Lever 2: Private labeling

- Lever 3: Increase AOV

- Lever 4: Reduction in Cost of acquisition

- Lever 5: Optimization scenarios (increased delivery times, delivery costs)

- Lever 1: Ad revenue– Zepto and Blinkit have started to pull ads as a lever and this lever forms only ~3% of GMV. In comparison, the benchmarks from E-commerce firms present a case of ~10% of GMV’s, indicating a further upside of 8% of GMV. This lever has margins >95%, meaning the upside would contribute purely to the margins. Hence, this presents a fantastic business case!

- Growth figures – # of advertisers have jumped by 130% to ~600, revenue figures grew by 220% and revenue concentration from top 20% advertisers is concentrated to only 40% of ad revenue, meaning more diversification.

- Lever 2: Private labeling– Market leaders have hinted to tap into Private labels to improve margins, with Zepto indicating to start their own line by 2024 end. Swiggy instamart’s category is proposed to be in the non-food category (cleaning equipment, toilet cleaners and dustbin bags). This is a long-term strategy and margins will be realized in 3-5 years horizon as revenue from private labels need to earn customer’s trust!

- Lever 3: Average order value (AOV): Increasing the AOV is a lever that will increase the net margins drastically. This is a work in progress as we can see the quick commerce firms have been growing the AOV values. With a higher AOV, the commissions per order give way to reaching operational profitability (remember Ashneer’s comments?). From an operations point of view, the quick commerce firms will be adding more categories and embody a competition for e-commerce firms (Amazon, Flipkart etc.)

- Lever 4: Reduction in cost of acquisition – With CAC % making up ~80% of commissions, the customer preferences and habit-built arounds comfort, the product life cycle hits a curve when the customers have a habit of ordering from the quick commerce firms. Hence, CAC figures would reduce significantly as the category has been created in the minds of customer.

- Lever 5: Optimization scenarios (increased delivery times, delivery costs) – There are 2-sub levers that are being evaluated. One, is to reduce delivery costs by optimizing the driver routes, increase dark stores to reduce drive commissions and tinker around with HR policies by keeping fixed driver’s vs part-timers. Other sub-lever is to increase delivery time from a 10-min to a 30-minute, in order make the entire ecosystem more sustainable. This opens batch ordering (multiple orders delivered through a single driver) and would be increasing the margins.

What happened to the competition – Are major players interested?

E-commerce is evolving and quick commerce is posing to be the one leading the revolution. This begs the question, how are the big players in the market reacting to it? In a nutshell,

- Flipkart will be launching its own <15 minutes delivery service by focusing on <15 cities. Dark stores have been setup with a sharp focus on FMCG, grocery & daily essentials with a long-term view by focusing on electronics & fashion

- Amazon has a segment (Amazon Fresh) which serves grocery and other daily items. Amazon Fresh is targeting Tier 2 & 3 regions and has expanded to 60 cities. 12+ cities have a slotted 2-hour delivery of items and it is reported, more than half of orders comes from these regions (Tier 2 & 3).

- Tata owned BigBasket – BigBasket has broken down the entire segment into 3 sub-segments: BBnow – 20 minutes delivery, bbsupersaver – 2-48 hour delivery and bbdaily – subscription model for daily essentials. The firm believes, increasing the delivery times closer to 30 minutes would bring sustainability to the business model. In the past year, ~30% of bigbasket’s overall orders are delivered through quick commerce, 80% of bbnow orders are delivered in 10-12 minutes. This indicates, the bigbasket is working towards gaining ground in the market.

Reliance backed Jiomart – The firm has shut shop last year owing to business fundamentals are not in line with firms business principles and ethos.

According to Strategy&Community, What do we think about where the Industry is headed?

- Slowly the Industry will move to 30 minutes delivery – The inflection point to profitability & customer habit lies closer to 30 minutes. This will help the quick commerce firms to inch closer to building a company reliant on strong business fundamentals

- Profit is going to be key – Discussions around profit would form the center stage in the next 2 years. The expansion plans to other cities will be kept on check.

- Differentiated USP – Amazon Fresh with its operational targeting of tier 2 & 3 regions is a key differentiator. E-Commerce saw the growth when these regions picked on these services. The upside to quick commerce is immense

- Government’s view – With the Central Consumer Protection Authority (CCPA) asking the industry leaders to share median delivery times to match the advertised delivery times, the trend indicates government will flag the fluff keeping the consumers interests in mind.

Sources: - Financial Express

- Inc42 - Gartner

- Economic Times

- Ken Research

- Finshorts

- RedSeer strategy consultants